Weekly Outlook | Important interest rate decisions ahead

Important events this week:

Markets are likely to be dominated by the Federal Reserve this week. It is expected that the central bank could cut rates, as Jerome Powell has previously announced. However, whether a move will materialize could be called into question and, if so, how much it will be.

Interest rate decisions will also be made by the British and Japanese central banks. In the UK, the interest rate is unlikely to be adjusted, although things could get exciting again in Japan. The Yen has recently continued to strengthen.

– CA- Consumer Price Index – The Canadian Dollar has recently shown a mixed picture. It continued to move slightly higher against the USD, but failed to realize its potential against the EUR. There could be further downside potential here for the time being. Consumer prices in Canada have also moved lower and could add fresh pressure on the Loonie as momentum falls.

A look at the weekly chart of the USDCAD shows that a break of the 50- moving average could then quickly move the market higher. On the other hand, there could be downside potential in the EUR if consumer prices rise slightly. The data will be published on Tuesday, 17 September at 14:30 CET.

– US interest rate decision – The most important event this week will be the interest rate decision from the USA on Wednesday evening. It is currently expected that the Federal Reserve will cut the rate by 25 basis points. Labor market data has recently moved downwards, which should now prompt the Fed to take countermeasures. Inflation data has also moved steadily downwards, which should ultimately necessitate action.

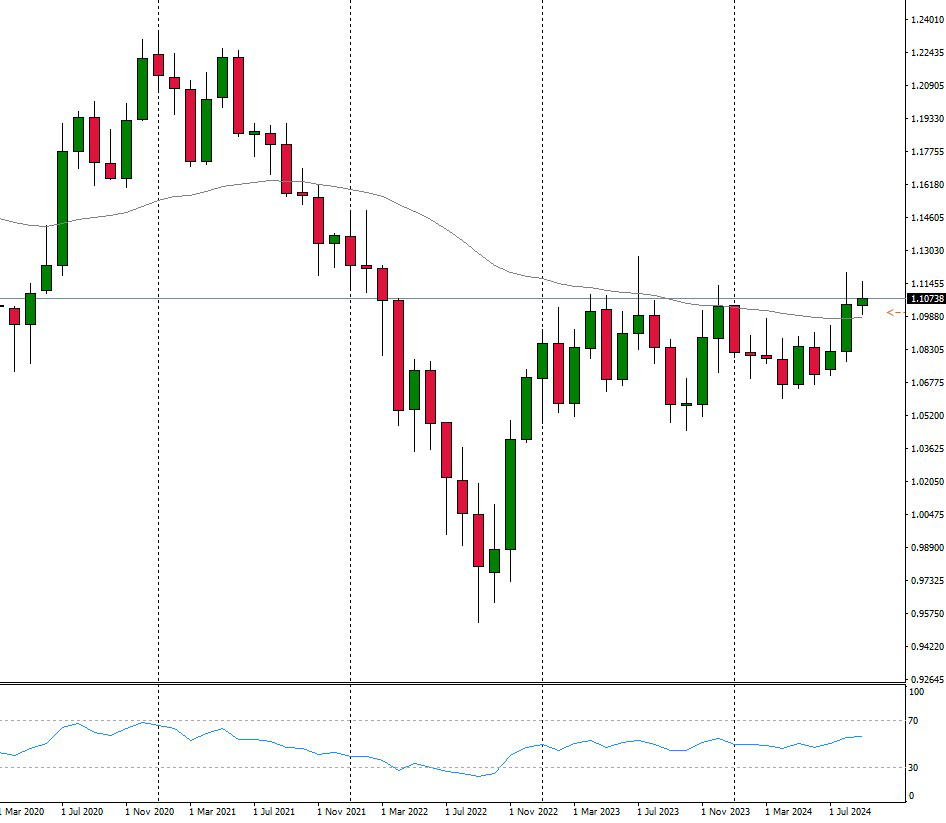

The EURUSD exchange rate was able to move positively again last week, while the Dollar came under pressure again. The trend in the monthly chart above signals possible further upward potential. The 50- moving average has already been breached here. The market is already trading above the psychological level of 1.1000. The interest rate decision will take place on Wednesday, 18 September at 20:00 CET.

– UK interest rate decision – An interest rate decision will also be made in the UK this week. However, it is not expected that rates will be adjusted. The expectation is that more central bankers will follow the camp of keeping interest rates unchanged.

On the GBPUSD daily chart, we can observe a fresh upward trend. If the event turns out as expected, the market might continue higher. The decision will take place on Thursday, 19 September at 13:00 CET.

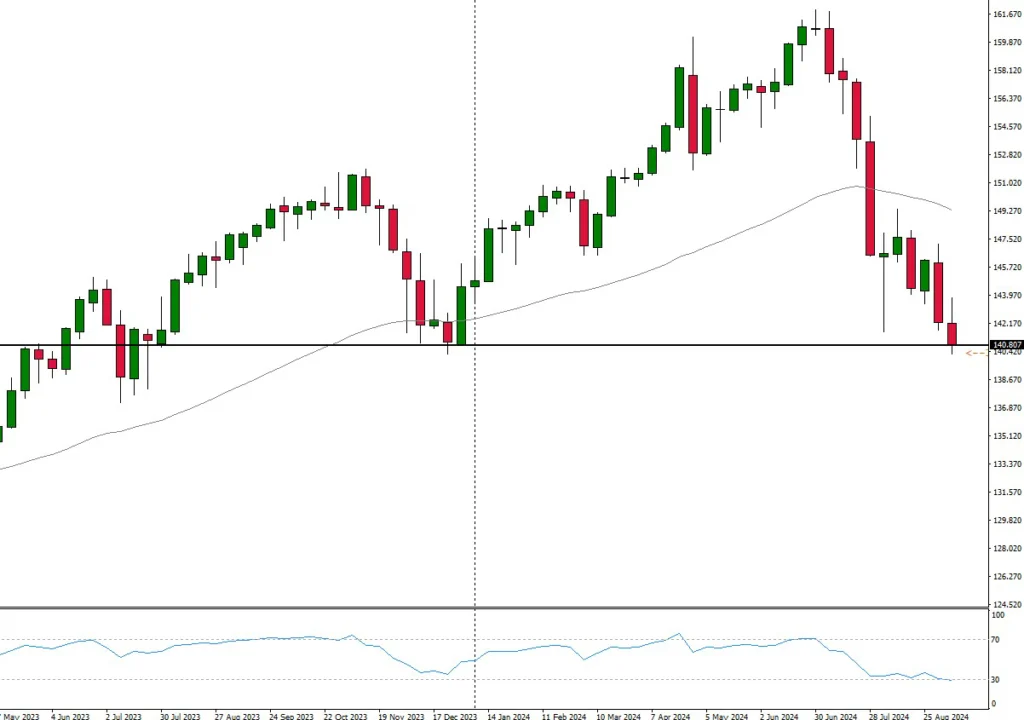

– JP- Interest Rate Decision – Japan will also have an interest rate decision this week. The market could well receive another rate hike, albeit a very small one. This could cause the JPY to rise.

However, the USDJPY price is currently trading directly on a support zone at 140.80 on the weekly chart. Only if this is broken could there be further downside potential. The interest rate decision will take place on Friday, 20 September.