Weekly Outlook | Dollar weak, equities positive, cryptos rising

Important events this week:

Last week, the Chinese government’s cash injection for the local economy made the headlines. The central bank had reduced short-term interest rates for 1-year loans, which directly led to strong demand for equities. Investors subsequently also bought US indices and the global appetite for risk turned positive. Cryptocurrencies also rose, with ETH once again rising.

– CN Purchasing Managers’ Index Production – The index could cause volatility this month. Following the recent government’s support for the economy, global markets are now on the rise, especially in China. Previously, Chinese companies had not followed the positive global trend. Concerns about the influence of the government had a negative impact, with the continuing fall in the property market also weighing on the economy. Overall, the data could also serve as an indicator global, as companies around the world also place a lot of orders in China. The index will be published on Monday, 30 September at 03:30 CET.

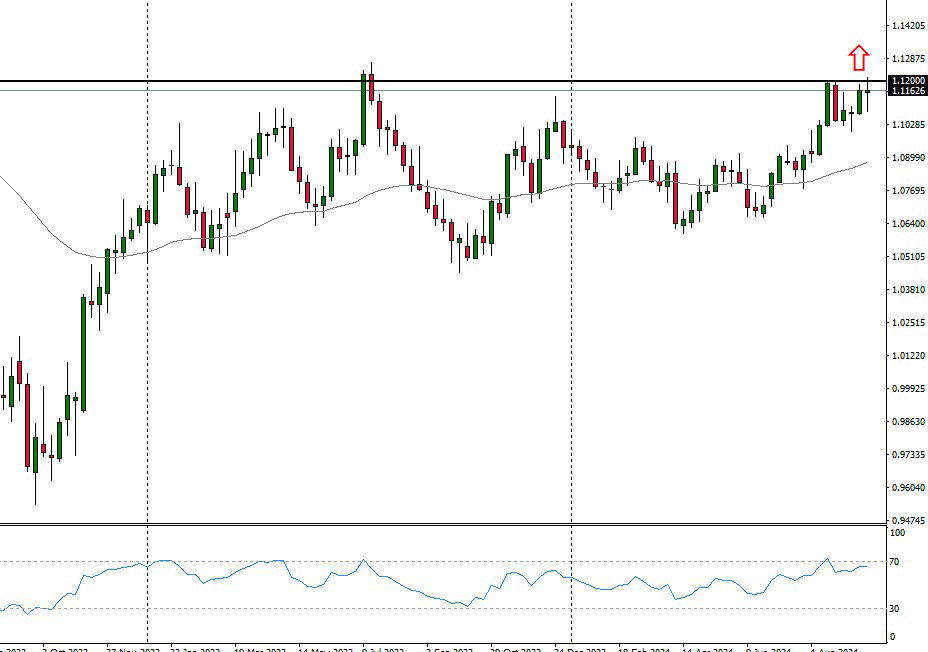

– US ADP Employment Change – With 124,000 new jobs created, this month’s figure is expected to be stronger. In the last release, the figure had fallen sharply and was negative by 45,000 positions at 99,000 compared to the expectation. The Dollar is currently under pressure and is losing value against most currencies. A weaker than expected figure could reinforce the trend. In this case, the Euro could appreciate against the Dollar and a breakout to the upside could occur.

If the market settles above the psychological 1.1200 zone, further momentum towards 1.1500 could emerge. The fact that the price is above the 50- moving average also has a positive effect on the weekly chart above. The figure will be published on Wednesday, 02 October at 14:15 CET.

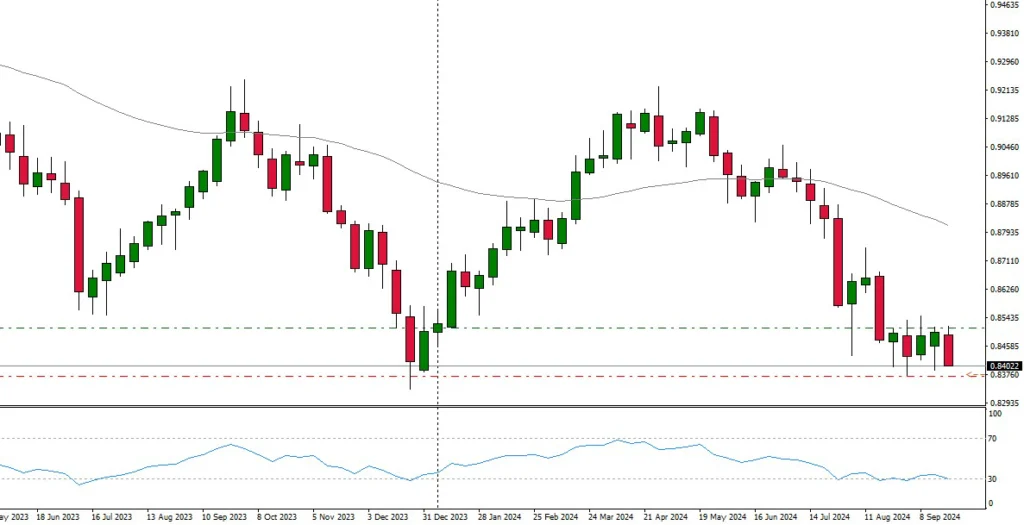

– CH Consumer Price Index – In Switzerland, key interest rates were not reduced last week. As a result, the Swiss Franc strengthened slightly, which was reflected in most currencies. The consumer price index could now move the market this week. If a further downward movement becomes apparent, the Swissy could fall further.

The weekly chart shows a strong support zone in the weekly chart of the USDCHF. Only if this is broken to the downside could the Swiss Franc show further potential. If the currency pair is able to move positively, the 50- moving average could be tested. The index will be released on Thursday, 03 October at 08:30 CET.

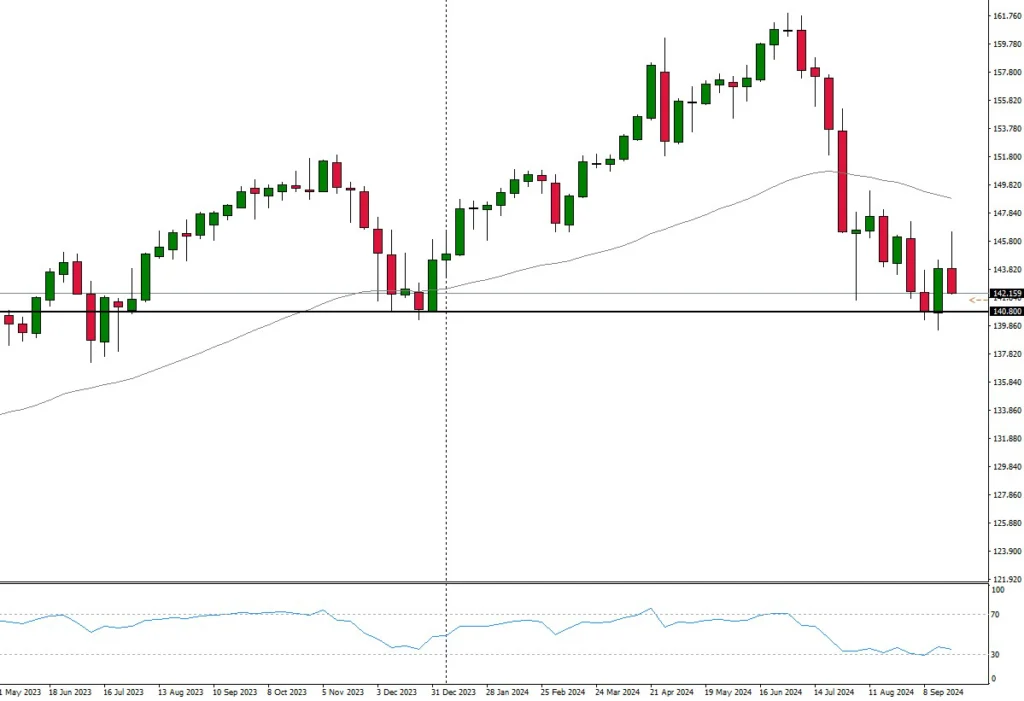

– US Nonfarm Payrolls – The most important data will follow this week with the NFP data from the USA. At 144,000, these are expected to be little changed compared to the previous period. A look at the USDJPY currency pair shows potential downside.

The market is trading below the 50-moving average, based on the weekly chart. A break of the support at 140.80 could quickly indicate further downside potential. The figure will be published on 04 October at 14:30 CET.