Wait-and-see mode as markets await inflation data

Headlines

* US GDP revised slightly lower despite stronger consumer spending

* Fed speakers generally cautious on rate cuts, a way to go to inflation goal

* Bitcoin surges past $60,000 with bulls eyeing up record high

* Dow inches down for a third straight day as traders await PCE data

FX: USD looked to be making a break higher, but sellers emerged in the European session, as well as after the US Q4 GDP data and as the stock sell-off eased. That was revised modestly lower from 3.3% to 3.2%. But we note the Atlanta Fed GDPNow latest forecast for the current quarter is 3.2%, so still highly respectable.

EUR dropped sharply early on before making its way back above its 200-day SMA is at 1.0827. There was no major data and comments from an ECB official had little impact. He said there was no reason to rush rate cuts and he favoured a June move.

GBP fell to a low of 1.2621 before getting back near to the 50-day SMA at 1.2676. Positive risk sentiment has been helping support sterling.

USD/JPY continued to consolidate just below recent highs from mid-February at 150.88. Treasury yields are doing similar below recent resistance. Data and BoJ comments are due later today.

Both AUD and NZD underperformed after the more dovish than expected tone from the RBNZ. The bank gave no indication that further rate hikes are a risk. Market had priced in around 6bps of a hike ahead of the meeting. Aussie CPI came in lower than expected further adding to bets that the RBA’s tightening cycle is done. USD/CAD popped up above 1.36 as it looked to breaking higher. Softer stocks and crude didn’t initially help the loonie. Resistance sits at 1.3623.

Stocks: US equities were all lower with tech the laggard. The benchmark S&P 500 closed 0.17% lower at 5,069. The Nasdaq 100 lost 0.54% to finish at 17,874. The Dow Jones settled 0.06% down at 38,949. Real estate led the best performers while communication services lagged. eBay surged nearly 8% after announcing a dividend increase and $2 billion in share buybacks.

Asian futures are pointing lower. APAC stocks were subdued on Wednesday following rangebound Wall Street. The Nikkei 225 remained above 39,000. Chinese stocks were initially pressured on real estate developer worries.

Gold edged higherbutstill around its 50-day SMA is at $2032. Resistance at $2040 could be broken if we get an upside breakout. That probably depends on bond yields moving lower, with eyes on the today’s US core PCE data.

Day Ahead – US Inflation data expected to rise

The US core PCE data lands later today and is a focus for the FOMC, as it is a broader gauge of prices that dynamically adjusts to changes in the spending basket. It is seen picking up in January, to +0.4% m/m versus the prior +0.2% and 2.9% y/y versus 2.8%. After both the CPI and PPI series surprised to the upside in January, expectations are for a solid report.

A monthly print of 0.4% is much stronger than the 0.2% that economists believe is needed to bring inflation back to the Fed’s 2% target over time. The flip side and softer data could mean prices are on track to hit the inflation goal earlier than expected. Importantly, Fed officials have repeatedly said they will begin loosening policy before the PCE measure returns to target.

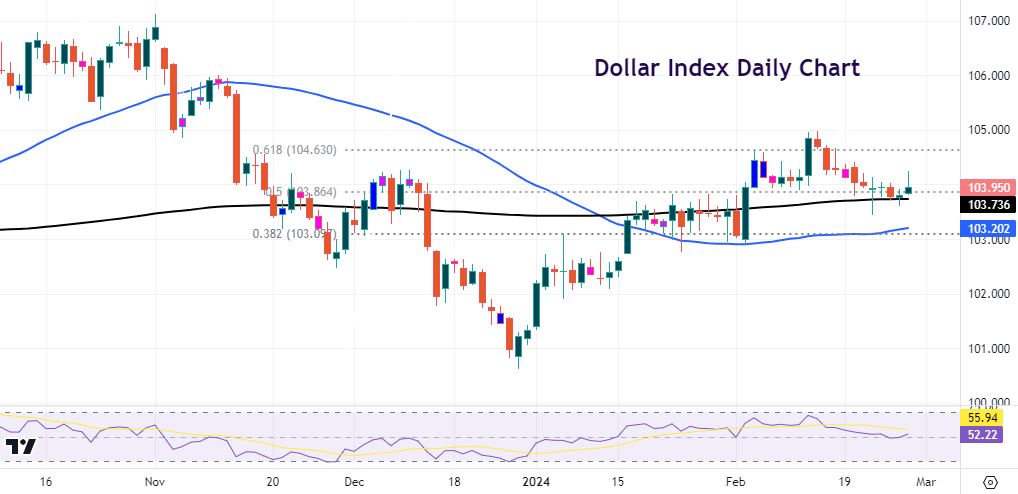

Chart of the Day – USD finds support

A weaker set of inflation figures would hit the dollar and help the risk rally. Market pricing is now seeing around three 25bp Fed rate cuts by year end and a 60% chance of a first move in June. This has been cut back hugely from the start of the year when there were around double (150bps) of policy easing priced in.

The dollar index has found support at the 200-day SMA at 103.73 and the 50% level of the fourth quarter rally at 103.86. If we get a soft report, then a move lower could find support at last week’s low at 103.43 A strong set of data could prices move up decisively above 104.