Now with the basics of technical and fundamental analysis covered in the previous articles, let us dive into the methods traders may use to enter a Buy or Sell position in the markets. Whether you’re a day trader or a long-term investor, having an optimal entry when placing a trade plays an important role in achieving trading success.

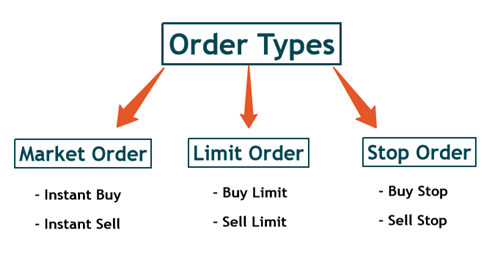

What Are The Different Order Types?

When it comes to entering a trade position in the financial markets, it is split into three major types: Market Order, Limit Order, and Stop Order.

Market Order = Instant Execution Buy/Sell

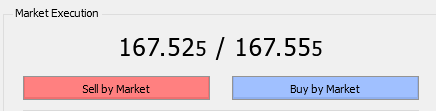

The most common order type is market orders, also known as instant executions.

Just as the name implies, the Buy or Sell position placed by the trader is instantly executed at the current price of the market, on a real-time basis. Depending on the chosen broker, the order placed automatically searches for the best available price in the market to execute the order.

Instant executions are particularly useful for traders who want to trade at the quoted price.

Do take note of the Forex market’s volatility, which could result in rapid changes in price. Hence, there will be instances where the marker order is executed at a slightly different price than the one intended.

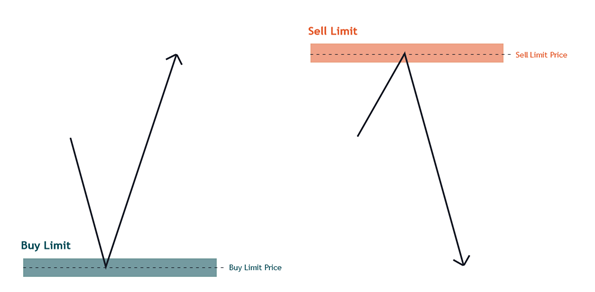

Limit Order (Pending Order) = Buy/sell Limit

A limit order will only be executed if the price reaches the trader’s desired level whereas the order will remain unfilled if the price does not reach such level.

Unlike instant execution where the trade is live from the moment traders buy or sell, traders would not pay a cent more for the order but it’s possible that it could be executed at a price lower than the pre-defined level.

Limit orders are usually used by traders who aim for the sharpest entry possible. Limit orders also do not require constant attention on the financial markets as the position would only be opened if the pre-defined limit order price is reached.

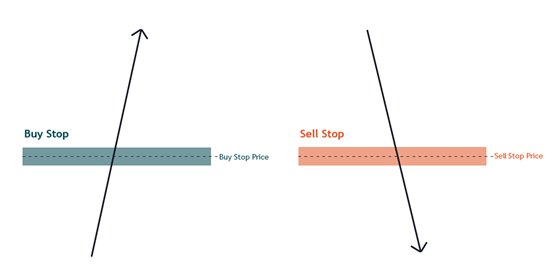

Stop Order = Buy/Sell Stop

Stop orders are usually used by traders who want to further confirm that the markets are trading in their favour before entering a trade, because stop order is always executed in the direction to which the market moves. Traders using stop orders want to buy into the markets only after prices have risen to the buy stop price, or sell only after the markets have fallen to the sell stop price.

So which market order type should you be using?

Different order types serve different trading preferences and goals. Through different order types, traders have an array of choices on how to enter the markets.

Want to try trading CFDs with different market orders? Practise it on our demo account.