From America to Japan and London, each advanced economy has their own representative stock market index. And it’s no different for Germany.

Published on the Frankfurt Exchange, the DAX (aka GER40) tracks the 40 best-performing commercial entities active in Germany. The companies chosen represent approximately 80% of the total market capitalisation traded on the Frankfurt Exchange; as such, the DAX is considered a significant benchmark of the German economy on the whole.

In this article, we’ll take a deeper look at the DAX, its key characteristics and what to consider when trading it.

What is the DAX Index? [1]

Weighted by market capitalisation, the DAX measures the performance of the 40 largest and most liquid companies listed in Frankfurt. It was created in 1998 with a starting reading of 1,163 points, initially covering only 30 blue-chip companies. This was later expanded in 2021 to admit 10 more new companies, improving the index’s coverage of the German economy.

Because of its component companies, the DAX is also sometimes known as the GER40. Its German name is “Deutscher Aktien Index”. The index is calculated based on prices provided by the electronic trading system Xetra, using a free-float method. This means that the market-capitalisation of each component only includes readily available shares, and excludes locked-in shares held by insiders, promoters, and governments.

The DAX is populated by several well-known MNCs, many of which are responsible for driving the German economy to great heights in the wake of World War 2. Some of these include Adidas, Allianz, Bayer and Volkswagen, covering several major sectors and industries from clothing to insurance, pharmaceutical and vehicle manufacturing. A full list of component companies will be included later in the article.

Key characteristics of the DAX index

The DAX is unique among its peers in that it does not utilise spot prices. Rather, it is updated with futures prices for the next day even after the close of the main stock exchange – a move rarely seen in similar indices.

The Frankfurt Exchange maintains the DAX by making necessary changes on regular review dates. Despite this, component companies may be removed at any time if they fall out of the top 45 largest companies, or break into the top 25.

Trading hours of the DAX

The DAX trades according to the hours of the Frankfurt Exchange. Due to its significance, pre-market and after-hours trading are also available.

Main trading hours

- Mon – Fri: 9:00 AM to 5:30 PM Central European Time (CET)

Pre-market and after-hours trading

- Pre-market: 8:00 AM to 9:00 AM CET

- After-hours: 5:30 PM to 8 PM CET

What companies are in the DAX? [2]

Here’s a partial list of the component companies found in the DAX. The list of top 10 companies is ordered by market capitalisation.

As at November 2024, the DAX has a combined market capitalisation of US$1.91 trillion.

| Company | Market capitalisation (billions, USD) |

| SAP | $275.85 |

| Deutsche Telekom | $154.33 |

| Siemens | $148.41 |

| Allianz | $118.38 |

| Airbus | $114.42 |

| Munich RE | $68.68 |

| Merck KGaA | $65.13 |

| Siemens Healthineers | $59.31 |

| Mercedes-Benz | $59.23 |

| Porsche | $56.59 |

Why trade the DAX?

The DAX acts as the main benchmark of the German stock market, focussing on several blue-chip stocks and well-established MNCs with long track records of good performance. Furthermore, many of these companies have grown into giants in their individual sectors, being among the top-rated brands on a worldwide scale.

Thus, the DAX represents an opportunity for investors to diversify their portfolio across multiple dimensions, such as large-cap blue-chip stocks, and also along regional lines, specifically the German economy.

Investors interested in gaining exposure to Germany’s economic performance can do so using the DAX as a convenient starting point. More experienced traders who are comfortable with greater volatility can also take reference from the DAX to spot potential blue-chip stocks to add to their trading list.

This is especially so since the DAX is more dynamic than other indices; instead of waiting till regularly scheduled rewired dates, the index’s components can fall off or admit new members once the relevant thresholds have been crossed.

Historical trends of the DAX

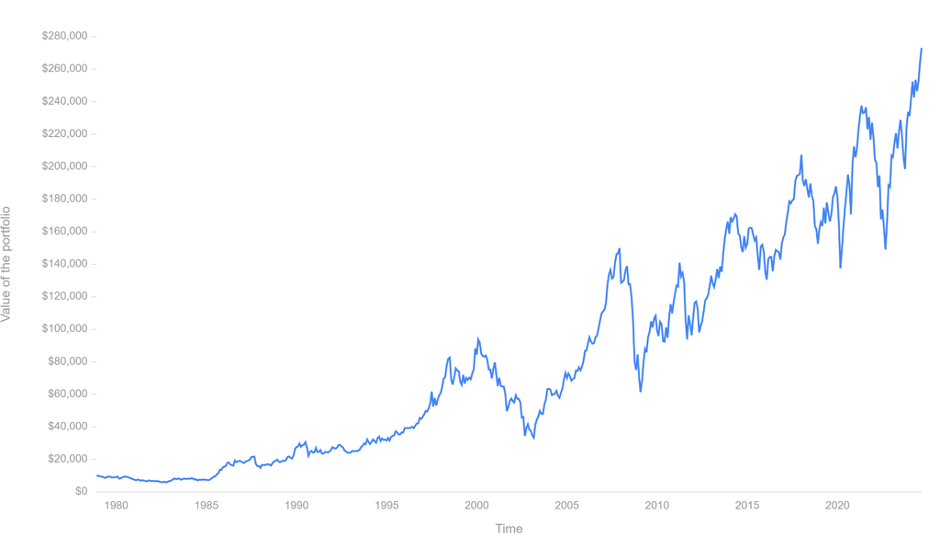

The screenshot above shows the historical performance of the DAX index. As you can see, the index – which closely reflects the state of the German economy – really only started taking off from the mid-1980s onwards.

It ran into its first major pullback during the dot.com crash of 2000, and then again during the Global FInancial Crisis of 2008. From then on, the index has charted an impressive upward trend, even in the face of the global COVID-19 pandemic.

How has the DAX performed so far? [3]

In the last 45 years, the DAX has achieved a compound annual growth rate of 7.51%. As at Nov 2024, the DAX has returned an average 16.89%, marking 2024 as a year of better-than-average performance.

The index’s three best and worst years are as follows:

Best years:

- 1985: +102%

- 2003: +62.5%

- 2007: +36.7%

Worst years:

- 2008: -43.6%

- 2002: -33.3%

- 2001: -24%

It is notable that the DAX tends to be choppier than some of its peers. It has a standard deviation of 21.8%, which is rather high for a national index. (For comparison, the FTSE has a standard deviation of just 14.78%).

This is attributable to the relatively small number of components of just 40 stocks, as well as the market-capitalisation weighting method used in the index’s calculation.

While the DAX is performing quite well at the time of writing, it is likely not for the faint-hearted, judging by the extremely long and deep drawdowns the index has experienced before.

A drawdown is defined as a period in time in which the index fell compared to a previously achieved peak.

The Dax had its longest-running drawdown lasting 6 years and 8 months, between December 1978 and August 1985. It reached a trough of -40.1%.

Meanwhile, its deepest drawdown lasted for 6 years and 2 months, between February 2000 and April 2006. The index fell by as much as -64.4% during this period.

How to trade the DAX index?

Being a benchmark, the DAX cannot be directly traded. Instead, traders and investors can trade the DAX via a variety of other financial instruments.

Exchange Traded Funds (ETFs)

There are several ETFs that track the performance of the DAX by maintaining the same mix of component companies. This essentially allows such ETFs to follow the index closely as it goes up and down.

Investors can purchase shares of an DAX ETF in order to gain a similar degree of exposure. Note that ETFs come with management fees that eat into your total returns.

Besides allowing exposure to performance of the DAX, ETFs also offer benefits such as flexibility and convenience. This is because ETFs are tradeable anytime on stock markets, making them highly liquid. As they are pre-loaded with the top 40 stocks as found in the DAX, ETFs offer inherent diversification.

Some popular DAX-tracking ETFs are:

- iShares Core DAX UCITS ETF (DE)

- Amundi ETF DAX UCITS ETF DR

- Vanguard DAX UCITS ETF Distributing

Contracts-for-Difference (CFDs)

Another way to trade the DAX index is through the use of a financial derivative known as a Contract-for-Difference (CFD). A CFD offers exposure to the price action of the DAX without direct ownership of any shares or component of the index.

By trading CFDs, investors can speculate on the direction that the DAX would go – up or down – and open a corresponding long or short position. Upon closing the contract, the difference in the level of the DAX from the time the contract was opened determines the resulting profit or loss.

Besides being able to trade both long and short positions, CFDs also facilitate greater capital efficiency though the use of leverage. This allows a trader to control a larger number of positions with a smaller starting capital, facilitating more advanced strategies. However, leverage will also amplify the outcome of your trade, whether it be a profit or a loss.

CFDs are highly popular and readily found, but investors should note that their complicated complex and fast-paced nature render them unsuitable for beginners or inexperienced investors. Care should also be taken to choose a reputable brokerage with low spreads and transparent fees to avoid spending too much on trading commissions.

Trading DAX futures

The DAX has come to be regarded as a reliable indicator not only of the German economy and the Eurozone on the whole, but also as a predictor of movements in the US stock markets. As such, more experienced traders also trade DAX futures, which are another form of financial derivative that require a fair level of experience.

Futures contracts are agreements to buy or sell an underlying asset at a predetermined price on a predetermined date. They are commonly used to hedge against price volatility by commodity traders.

In the case of DAX futures, the contract moves up or down by a fixed dollar amount for each point the DAX moves. There are no underlying assets exchanged; instead the contract is settled up in cash at expiry.

Here are the key characteristics of DAX futures.

- Available in three sizes

- FDAX (EUR 25 per index point)

- FDXM (EUR 5 per index point)

- FDXS (EUR 1 per index point)

- Trading hours: Sunday to Friday, 7:00 pm to 4:00 pm ET

- Duration: Quarterly (March, June, September, December)

- Close: The third Friday of the relevant month, or the day immediately preceding in case of holiday or closure

Considerations when trading DAX futures [4,5]

It’s important to understand that the price of a futures contract is determined by supply and demand from the market, with investors attempting to anticipate the level of the index on the settlement date.

When trading DAX futures, a trader has to maintain a separate margin account with their brokerage. For every point that the DAX future moves, the corresponding euro amount will be either debited or credited to the margin account.

If the margin in the account is no longer sufficient, the investor faces a margin call, requiring additional funds to be deposited. Failing to do so will result in the brokerage closing the position immediately.

Clearly, the full-sized FDAX, which moves at EUR 25 per index point, is too large for most retail investors or short-term traders. Typically, FDAX is only traded by institutional investors, or traders with the capital to pursue a long-term strategy.

For retail investors and short-term traders, the FDAM and FDAS, with their smaller lot sizes (EUR 5 per point, and EUR 1 per point respectively), may make for more suitable choices.

With narrower price changes per index point movement, such futures contracts allow traders more flexibility to trade multiple contracts and employ wider stops, increasing the potential for profit.

Analysing DAX market factors

Technical analysis of the DAX index

Technical analysis involves the use of charting tools and technical indicators on a price chart of the DAX index in order to discern patterns, gauge market sentiment and spot incoming trends.

Notably, the practice focuses only on past price action as seen on the price chart, and purists have been known to eschew all other sources of information as market noise that could obscure what’s really happening.

Of course, having such a high degree of faith in technical analysis alone requires a deep understanding of the practice. Proponents advise that technical analysis demands – and rewards – dedication and mastery.

Technical analysis revolves around knowing how to plot and interpret technical indicators and drawings. These can range from simple to advanced. Some popular, beginner-friendly technical indicators are:

- Trend lines. These are straight lines plotted along the tops or bottoms of a region in a price chart, crossing or joining as many points as possible. The slope of the line, as well as the direction, clearly indicates price trends – whether up, down or sideways. When applied to the DAX, trendlines can help to confirm whether a trend is continuing or a change is incoming.

- Relative Strength Index (RSI). The RSI is an oscillator that is typically plotted underneath the main price chart. It measures the speed and change of price movements, and is measured on a scale of 0 to 100. Conventionally, readings over 70 indicate an overbought market, while readings under 30 point to an oversold market. In relation to the DAX, the RSI can help a trader gauge bullish or bearish price momentum.

- Chart patterns. Price charts are conventionally displayed using the bar chart format, with each bar indicating a set trading period (such as a trading day). Hence, by looking at patterns formed by consecutive bars, a technical analyst can be alerted to potential incoming price movements. There are several chart patterns to learn about, but generally, each one spans between 2 to 5 bars, with 3 bars being the most common. They can indicate bullish or bearish trends forming, and as such, can help investors confirm or deny trend reversals in the DAX.

Fundamental analysis of the DAX

The counterpart to technical analysis is fundamental analysis, which centers around keeping track of news, events and developments that can have material impact on prices. For stock market indices like the DAX, fundamental analysis is a powerful way to be alerted to incoming price movements and potential trading opportunities.

As the DAX’s performance is directly impacted by the prices of its component stocks, fundamental analysis here also means taking a look at the market factors that could impact these companies.

These can range from internal factors such as earnings forecasts, scandals, and executive changes, to external ones such as regulatory changes, consumer trends, oil production and war.

See the next section for a more detailed discussion.

Market factors impacting the DAX index

Global economic conditions

Recall that the DAX is populated by many MNCs with exposure to overseas markets. As such, global economic conditions can exert considerable influence over the performance of DAX component companies, in turn affecting the index.

For instance, German exports typically do well during periods of global economic expansion, when there is more demand for high quality German products. Conversely, recent fears over a weakening US economy – coupled with threats by Trump to slap new trade tariffs on imports – could see German exports drop by as much as 15% [6].

If this were to play out, it is conceivable that the performance of several DAX components would be negatively impacted, which would likely hamper the DAX’s performance.

Company performance

Even if the global economic outlook remained sunny for Germany, the DAX could still experience a decline if its component stocks fall. This is dependent on the performance of all 40 companies tracked by the index, which could face poor performance from a weakening German economy.

Indeed, recent reports suggest business confidence is sinking among German companies, with the ifo Business Climate Index in September falling to the lowest level since July 2020. This was on the back of shrinking orders and dimmed business outlooks [7].

Should the worries over economic weakness in Germany indeed play out, and companies experience lowered business outcomes, the DAX is bound to follow suit sooner or later, with lowered index readings as component stocks experience stock price declines.

Central bank policies

Global economic conditions, import tariffs, company performance and business sentiment aren’t the only market factors that could affect the direction of the DAX index. Another significant factor is central bank policies.

Specifically, while the factors discussed previously exerted negative influences on the DAX, the benchmark remained cherrily buoyant, even approaching all-time highs as recently as end-September.

Upon further analysis, this was attributed to monetary easing from several major central banks in a bid to stimulate economic activity. Rate cuts expectations from the US and China helped shore up investor confidence, keeping prices of blue-chip stocks high.

Most pertinently, weak economic data from the eurozone fueled further expectations of rate cuts from the European Central Bank; this further boosted investor confidence, allowing the DAX to remain resilient in the face of softening economic data.

This event nicely demonstrates that when evaluating market factors during fundamental analysis, it’s important to get a well-rounded and balanced view of pertinent data, rather than relying too heavily on one or two perspectives.

Currency fluctuations

It should be noted that changes in foreign exchange rates caused by currency fluctuations can also impact the DAX.

This is due to the cross-border nature of many of its top component stocks; these companies will be impacted if the euro rises or falls against other relevant global currencies.

Geopolitical events

And lastly, market indices like the DAX can be impacted by events happening in other global regions. This is unavoidable, given the closely intertwined nature of the global economy, and the multi-national character of Germany’s blue chip companies.

As an example, in mid-November, the DAX fell by nearly one percent, driven by renewed worries over escalation in tension between Ukraine and Russia [8].

Trading strategies for the DAX index

Before we wrap up this article, let’s discuss some common trading strategies that may be applied to the DAX.

Due to its status as a national stock market benchmark, the relatively small collection of component stocks, and the well-known nature of its blue-chip constituents, the DAX is highly suited to a large variety of trading strategies.

Short-term trading strategies

Day trading

As it is hosted on the electronic trading system Xetra, the DAX is calculated in real time and updated every second. This means the value of the DAX is constantly changing to reflect the latest stock prices of its components, which themselves fluctuate as the trading day goes on.

As such, the DAX is highly suited to day trading, in which traders focus on making several small trades lasting from minutes to hours. The goal of day trading is to stack up small profits across several short-lasting trades, instead of trying to capture large profits over a single trade. In this trading strategy, no positions are held overnight to avoid the risk of disruptive events or news happening outside of trading hours.

News trading

Another short-term trading strategy to consider is news trading. As per its name, news trading revolves around keeping track of pertinent news and corporate announcements to discern potential trading opportunities.

Given the high-profile nature of DAX constituent stocks, investors may find news trading to be a viable strategy as it is relatively easy to find and keep track of news that are likely to impact the DAX.

However, as discussed above, it is also crucial to maintain a well-rounded view, and perhaps incorporate technical analysis to better test trading ideas.

Mid-term trading strategies

Swing trading

The dynamic price action of the DAX creates opportunities for investors to attempt a swing trading strategy.

In swing trading, the goal is to capture profits by entering a position just when the price of an asset is changing. The idea is to capture the chunk of a potential price swing, and get out just before the trend reverses.

To be successful, a swing trader must first be able to correctly identify where the DAX is likely to move next, and then set up a trade to capture profits if the move materialises. For this reason, swing traders routinely make use of technical analysis to help them find appropriate trade entry and exit points.

Mean reversion or momentum

A mean reversion trading strategy bets any asset that has temporarily deviated from its historical average will soon return to its historical trend line. A trade is made to potentially capture profits when the asset price goes back to the mean once short-term volatility has passed.

Meanwhile, if there is reason to believe the breakout will continue, traders may instead make a momentum trade according to this new direction. The goal of a momentum trade is to capture potential profits should the trend continue to gain strength.

For example, higher-than-expected corporate earnings will likely cause a short-term bump in the DAX. But this could also increase investor confidence, causing higher demand for component stocks that could prolong the rally in the DAX.

Long-term strategy

Buy-and-hold

The DAX is well-suited to long-term traders who favour a buy-and-hold strategy, which can be conveniently executed via a DAX-tracking ETF.

Given the long-range historical performance of the index, it can be seen that a sufficiently long investment horizon would benefit the investor with significant capital appreciation.

However, the DAX is also more volatile than other national indices, so investors should be prepared with a higher risk appetite. Also, the DAX may outperform other popular indices in some years, but overall performance may lag other indices tracking larger companies or a greater number of component stocks.

Care should be taken to regularly review your DAX holdings for optimal outcomes.

Risk management when trading the DAX

The main risk of trading the DAX comes from its volatile nature, as the index has a rather high standard deviation of over 20% [9]. Thus, it’s important to practise proper trade sizing and avoid taking overly large trades that could wreck your trading account.

Another risk factor stems from the index’s regional character. The DAX is tied to the performance of top German MNCs that are affected by market factors in the eurozone as well as globally. Thus, consider diversifying your portfolio with other indices or assets that are less dependent on regional issues or local events.

Trade the DAX with Vantage

Vantage Markets offers CFD trading for the DAX and several other leading national stock market indices. Gain exposure to the dynamic price action of Germany’s top-performing blue-chip stocks without the hassle of direct ownership.

Save on trading costs with tight spreads and transparent pricing, improve capital efficiency with leverage trading, and benefit from our robust customer support system. Hone your knowledge and skills with our in-depth educational resources across articles, guides, news and explainers, and trade with confidence on market-leading trading platforms with powerful charting tools and capabilities.

Experience the Vantage advantage today. Sign up to start trading now!

References

- “DAX Stock Index: Definition and Member Companies – Investopedia”. https://www.investopedia.com/terms/d/dax.asp . Accessed 26 Nov 2024.

- “Largest DAX companies by market cap – Companies Market Cap”. https://companiesmarketcap.com/dax/largest-companies-by-market-cap/ . Accessed 26 Nov 2024.

- “Historical performance of the DAX index – Backtest by Curvo”. https://curvo.eu/backtest/en/market-index/dax?currency=usd#chart . Accessed 26 Nov 2024.

- “DAX future – Boerse Frankfurt”. https://www.boerse-frankfurt.de/en/know-how/lexikon/dax-future . Accessed 27 Nov 2024.

- “How to Trade DAX® Futures – StoneX Futures”. https://blog.stonexone.com/how-to-trade-dax-futures-stonex . Accessed 27 Nov 2024.

- “German industry fears tariffs after Trump’s victory as markets react – Yahoo! Finance”. https://finance.yahoo.com/news/german-industry-fears-tariffs-trumps-184308596.html . Accessed 2 December 2024.

- “German business confidence tumbles: Why is the DAX index defying gravity? – Euronews”. https://www.euronews.com/business/2024/09/24/german-business-confidence-tumbles-why-is-the-dax-index-defying-gravity . Accessed 27 Nov 2024.

- “DAX Slips As War Worries Return – Nasdaq”. https://www.nasdaq.com/articles/dax-slips-war-worries-return . Accessed 27 Nov 2024.

- “Historical performance of the DAX index – Curvo”. https://curvo.eu/backtest/en/market-index/dax?currency=usd . Accessed 2 December 2024.