Copy Trading, a rapidly expanding service within the realm of retail trading, is a popular form of trading that enables traders to replicate the trades of others [1]. This powerful tool allows individuals to harness the expertise of Vantage’s Signal Provider, making it an invaluable resource for traders across various skill levels. In this article, we will guide you through the process of identifying suitable Signal Providers, while delving into the benefits it offers to both novice and seasoned traders.

What are Signal Providers?

Signal Providers are expert traders who publicly share their portfolio and strategies for Copiers to replicate in real-time.

Why Should You Copy Signal Providers?

Here are three great reasons to copy from Vantage’s Signal Providers:

1. Learn from expert traders

Copying trades from experienced Signal Providers offers you a valuable opportunity to learn from their experience and mimic their potential returns. By replicating their trades, you can adopt their strategies and through the process, gain insightful trading knowledge. However, it’s important to keep in mind that past performance is not always indicative of future results, and even the best of us could have moments of crisis. Therefore, you’re encouraged to do sufficient research and due diligence before copying any Signal Provider.

2. Time-efficient solution

Becoming a skilled trader requires a significant investment of time and effort, which those with full-time jobs often cannot afford. Copy Trading offers a time-efficient alternative, alleviating the need for extensive independent research and market analysis. Anyone, anywhere, at any time, can copy a Signal Provider and passively take advantage of market opportunities.

3. Beneficial for new and experienced traders

Copy Trading from successful Signal Providers may benefit novice and seasoned traders alike. Novice traders stand to gain wider exposure to successful trading strategies while experienced traders can use Copy Trading to diversify their portfolios and expand their trading strategies by copying successful traders in different markets or with different approaches.

For example, a swing trader might choose to copy a successful day trader, broadening their portfolio and risk management. This approach also enables experienced traders to study and learn from proven trading strategies employed by other successful Signal Providers.

How to Find and Select Signal Providers to Copy

Understanding Your Trading Needs

While the excitement around making your first copy trade is a good thing, diving headfirst without defining your goals can lead to poor judgement when selecting a Signal Provider to copy.

To begin with, decide on your base capital, determine your risk tolerance, and choose the types of products you’d like to copy.

1. Capital

Capital is a crucial aspect for Copiers to consider.

For instance, you might find a Signal Provider whose portfolio has proven profitable in your preferred product. However, your capital of USD 2,000 cannot match their USD 25,000.

Fortunately, configuring the Copy Mode makes it possible to even out the playing field. You can manage the potential return of your trades based on your margin or preferred lots.

2. Risk Tolerance

Are you a daring risk-taker or a careful conservative?

Understanding your position on the risk spectrum will help you select a Signal Provider with a matching risk tolerance.

All Signal Providers have a Risk Band indicated in their Profiles, ranging from 1 to 10, where 1 represents low risk and 10 represents high risk.

Observing when a Signal Provider closes their positions can also reveal their risk appetite – risk takers often push support and resistance levels before deciding to close the trade.

As a golden rule, it’s better to be more conservative with risk than aggressive in pursuit of rewards.

3. Portfolio

Are you keen to invest in gold, stocks or orange juice?

Start by searching for a market you’d like to focus on, then filter Signal Providers who trade in those markets.

Explore their profiles to see what other products they trade frequently. Additionally, you can also view their monthly returns, number of copiers, and more to determine whether they suit your trading preferences.

It is also good practice to note how long the Signal Provider has been trading to gauge their level of experience. However, keep in mind that this is just one of several factors to consider when evaluating their suitability for Copy Trading.

4 Things to Look Out For When Selecting Your Signal Provider

Narrowing down your preferences will help you find a Signal Provider that aligns with your trading goals. Once you’ve ironed these out, you’ll have an easier time scouting for a suitable Signal Provider to follow. Here are some criteria you can look out for:

1. Return Percentage

The percentage return is a key metric used to evaluate a trader’s performance. It’s important to note that the return percentage can vary depending on the trader’s strategy and the market conditions. A high return percentage may indicate that the trader is taking on greater risk in order to achieve those returns. Copiers should consider the return percentage in conjunction with other criteria, such as the trader’s risk band and drawdown, when evaluating a trader’s performance.

2. Monthly Return

The monthly return is a useful metric to evaluate a trader’s consistency over time. A trader who consistently generates a positive monthly return over a long period of time may be more reliable than a trader who generates a high return in one month but experiences losses in the following months. Copiers should also consider the time period over which the monthly return is calculated and choose a period that is appropriate for their trading goals.

3. Drawdown

Drawdowns measure the risk associated with a trader’s strategy. A high drawdown percentage may indicate that the trader is taking on greater risk to achieve higher returns. However, it’s important to note that drawdowns can also be caused by external factors, such as market volatility, and may not always be indicative of the trader’s skill. Copiers should consider the drawdown percentage in conjunction with other criteria, such as the trader’s return and risk band when evaluating a trader’s performance.

4. Risk Band

The Risk Band is a crucial indicator that measures portfolio risk. It’s a numeric value ranging between 1–10. The higher the value, the higher the risk. A trader with a higher risk band may be taking on greater risk in order to achieve higher returns, while a trader with a lower risk band may be more conservative and focus on preserving capital.

Risk Bands are calculated using an algorithm that analyses key factors from a portfolio, which are:

- The volatility of the products

- The volume and capital allocated for each product

- The variety of directions of each position (if a portfolio is constantly only opening “Buy” positions, it’ll be considered risky)

- The leverage used to expose the portfolio

Risk Bands are updated daily on every Signal Provider’s profile page.

Searching for a Signal Provider

Narrowing down your preferences will help you find a Signal Provider that aligns with your trading goals. Once you’ve ironed these out, you’ll have an easier time scouting for a suitable Signal Provider to follow.

On the Community Page, you will find an extensive list of Signal Providers from all around the world. On the Vantage App, we have well over 70,000 Signal Providers who actively trade. Each of them has been observed and categorised by our algorithm into five areas:

- Most Copied

- Highers Annual Return

- Low Risk and Stable Return

- High Win Rate

- Top Signal Providers

It’s important to note that while Signal Providers are categorised in these areas based on our algorithm, this does not guarantee ideal outcomes. You can choose among these options based on your priorities, and further filter them based on time period, risk band and more.

Choosing the right Signal Provider

Clicking on a Signal Provider will lead you to their profile which features a holistic run down of their trading statistics.

When choosing a Signal Provider, take note of their trading results and evaluate whether they align with your goals. Is their monthly return ideal, is their risk band within your comfort range, are the products they trade within your area of interest?

Looking at their profile will answer all your questions.

Once you’ve found a Signal Provider you are satisfied with, you may click on ‘Copy’.

Find your ideal copy mode

Many users have the misconception that Signal Providers are the defining factor of a copy trade’s success. While it is true that the outcome of a trade depends on their strategies, Copiers are not completely at their mercy. As a Copier, you have significant control over how your copy trades are reflected in your account.

Before applying for a copy trade, you’ll be directed to a page to configure your preferred Copy Mode. This mode determines how your trades will mirror the original strategy curated by the Signal Provider.

Simply put, copy trades are not merely a 1:1 replication. You have the flexibility to adjust them according to your comfort level and risk tolerance through your selected Copy Mode. Whether you are an elite trader or an avid follower, it is important to understand the purpose of each Copy Mode.

The 3 Copy Modes available

Margins and lots are the key elements that determine your copy trade.

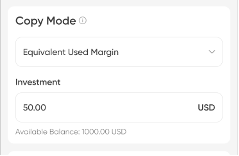

1. Equivalent Used Margin

Selecting this mode means that the volume of a trade copied to your account is based on margin levels proportional to those of the Signal Provider’s.

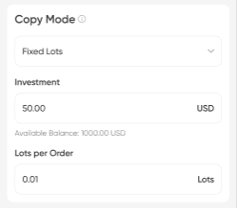

2. Fixed Lots

This mode means that the volume of your copy trade is identical to your pre-set value. For example, if you input 0:01 lots per order, your copied volume will be 0.01 lots, matching the original strategy.

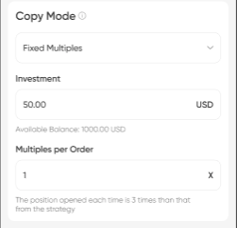

3. Fixed Multiples

Fixed Multiples mean the volume of a trade mirrored in the Copier’s account is a multiple from the original order size from the Signal Provider. For example, if you choose a multiple of 3, each copied position will be 3 times the size of the original strategy. This Copy Mode is suitable if you have a higher risk tolerance, or if you have full confidence in the Signal Provider’s strategy.

Do Copy Modes apply to all copy trades?

No, Copy Modes do not apply to all copy trades. They are configured at the start of each individual copy trade.

This allows you to test a Signal Provider’s strategy with a smaller pool of funds and adjust it as needed, providing flexibility regardless of the outcome.

What is Profit Sharing?

Profit Sharing is a model that allows Signal Providers to earn a portion of their Copier’s success.

The Profit Sharing Ratio represents the percentage of “Eligible Profits for Sharing” made by a Copier that will be paid out to the Signal Provider. This ratio determines the amount of profits shared between Copiers and Signal Providers. The default is set at 0% but can be adjusted in 5% increments up to a maximum of 50%.

The Settlement Cycle

Section A

The system calculates your Pending Profits on Settlement Day.

You have the choice to calculate settlements either daily, weekly (every Saturday) or monthly (the first calendar day of the month).

- Current Profit Sharing Ratio is the percentage of Eligible Profits for Sharing made by a Copier that will be paid out to you.

- Current Profit Sharing Ratio is set at 0% by default. The ratio ranges from 0% to 50%, with a 5% adjustable interval.

- Eligible Profits for Sharing is the positive difference between Copier’s Current Floating Profits minus High Water Mark (if any). If the difference is negative, there will be no profit sharing.

Scenario

Settlement Cycle

Copier = (C), Signal Provider = (SP)

(C) Current Floating Profits – (C) High Water Mark = (C) Eligible Profits for Sharing

i.e. USD 200 – USD 100 = USD 100

i.e. USD 50 – USD 100 = – USD 50 (no profit sharing)

Signal Provider sets Current Profit Sharing Ratio at 20%, Pending Shareable Profits = USD 0

(SP) Current Profit Sharing Ratio x (C) Eligible Profits for Sharing = (SP) Current Floating Profits

i.e. 20% x USD 100 = USD 20

Section B

For Current Floating Profits to become Pending Profits and be paid out to you, all profit sharing conditions must be met:

1. Profit is made when you close your trade. Your Copier has value under Shareable Profits for copying your trade.

2. Your Copier has sufficient balance for the deduction of value under Shareable Profits

3. Your Copier’s margin level remains above 100% after the deduction mentioned in 2.

Profit Sharing Calculation

Illustration 1

| Copier’s Current Floating Profits exceeds High Water Mark | Yes |

| Copier’s Eligible Profits for Sharing multiplied by the Signal Provider’s Current Profit Sharing Ratio is positive in value | Yes |

| Copier’s balance after deducting Shareable Profits is positive in value | Yes |

| Copier’s margin level after deducting Shareable Profits is above 100% | Yes |

| Copier’s account balance is above $200 | Yes |

| Pending Shareable Profits | Eligible for sharing |

Settlement Cycle

Copier = (C), Signal Provider = (SP)

(C) Current Floating Profits – (C) High Water Mark = (C) Eligible Profits for Sharing

i.e. USD 200 – USD 100 = USD 100

Signal Provider sets Current Profit Sharing Ratio at 20%

(SP) Current Profit Sharing Ratio x (C) Eligible Profits for Sharing = (C) Shareable Profits

i.e. 20% x USD 100 = USD 20

Shareable Profits = USD 20

Pending Shareable Profits = Eligible for profit sharing

Illustration 2

| Copier’s Current Floating Profits exceeds High Water Mark | Yes |

| Copier’s Eligible Profits for Sharing multiplied by the Signal Provider’s Current Profit Sharing Ratio is positive in value | No |

| Copier’s balance after deducting Shareable Profits is positive in value | No |

| Copier’s margin level after deducting Shareable Profits is above 100% | No |

| Copier’s account balance is above $200 | No |

| Pending Shareable Profits | Not eligible for sharing |

Settlement Cycle

Copier = (C), Signal Provider = (SP)

(C) Current Floating Profits – (C) High Water Mark = (C) Eligible Profits for Sharing

i.e. USD 100 – USD 200 = -USD 100

Signal Provider set Profit Sharing Rate at 20%

(SP) Current Profit Sharing Ratio x (C) Eligible Profits for Sharing = (C) Shareable Profits

i.e. 20% x -USD 100 = -USD 20

Shareable Profit = -USD 20

Pending Shareable Profits = Not eligible for profit sharing

Illustration 3

| Copier’s Current Floating Profits exceeds High Water Mark | Yes |

| Copier’s Eligible Profits for Sharing multiplied by the Signal Provider’s Current Profit Sharing Ratio is positive in value | Yes |

| Copier’s balance after deducting Shareable Profits is positive in value | Yes |

| Copier’s margin level after deducting Shareable Profits is above 100% | No |

| Copier’s account balance is above $200 | Yes |

| Pending Shareable Profits | Not eligible for sharing |

Settlement Cycle

Copier = (C),Signal Provider = (SP)

(C) Current Floating Profits – (C) High Water Mark = (C) Eligible Profits for Sharing

i.e. USD 200 – USD 100 = USD 100

Signal Provider set Current Profit Sharing Ratio at 20%

(SP) Current Profit Sharing Ratio x (C) Eligible Profits for Sharing = (C) Shareable Profits

i.e. 20% x USD 100 = USD 20

Shareable Profits = USD 20

Pending Shareable Profits = Not eligible for profit sharing

More ways you can learn about Copy Trading

#1 Explore the Academy

Discover all you need to know about Copy Trading, from its uniquely community-driven mechanics to how you can become a successful copy trader.

#2 Glossary

Expand your understanding of Copy Trading terminology and jargon through the Glossary.

#3 FAQs

Do you have a burning question? Check out the FAQ page at the top of the widget line for more information about Copy Trading.

#4 Chat with Customer Support

Our award-winning 24/7 customer service representatives are ready to answer your questions. Click the icon at the top right corner of the Profile tab to reach out to the team.

Conclusion

Copy Trading with the top Vantage experts can be a powerful option to help you learn from experienced traders and save time while potentially reproducing their returns. By carefully evaluating these criteria, you can choose a Signal Provider that fits your trading goals and risk tolerance. Download the Vantage App today and start copying from as low as $50! Find out more about Vantage Copy Trading here.

Reference

- “Is Copy Trading Still Popular in 2022? – Finance Magnates”. https://www.financemagnates.com/forex/analysis/is-copy-trading-still-popular-in-2022/. Accessed 13 April 2023.