Weekly Outlook | The Dollar gears up steam

Important events this week:

There was little important data on the economic calendar last week. Overall, markets were hardly volatile due to that. However, there is likely to be fresh potential in markets this month starting with this week. The Dollar ultimately showed slight momentum at the end of August and this could now continue during the first few trading days. Attention should therefore be paid to the non-farm payrolls report, as this could cause further potential in both directions.

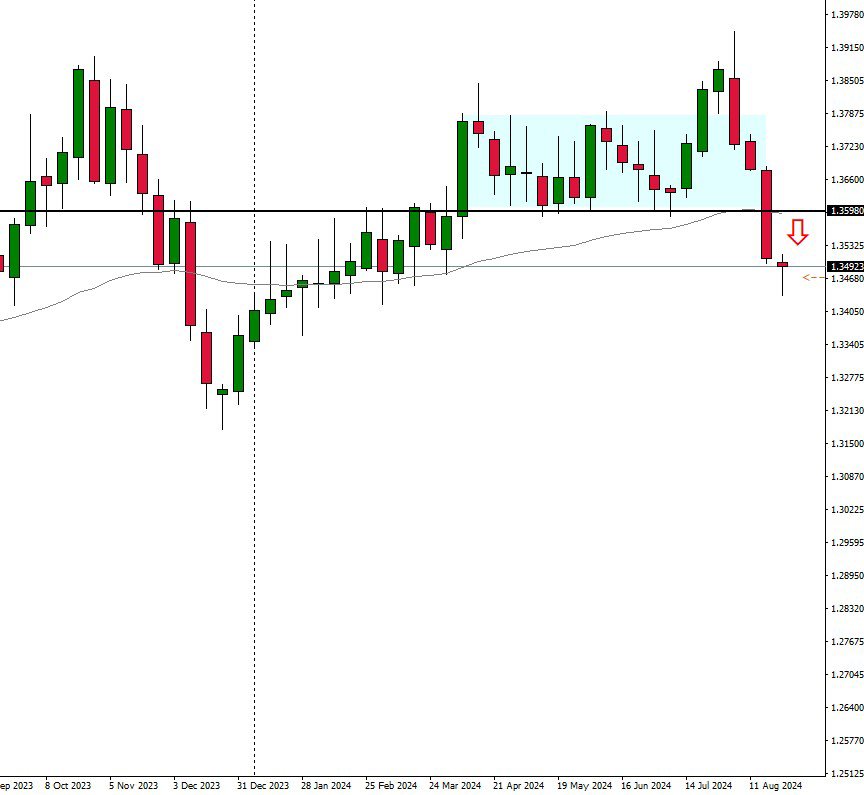

– CA key interest rate decision – The trading week begins on Wednesday with the interest rate decision from Canada. So far, the central bank is expected to cut rates. The last rate cut was implemented in June. However, the Canadian Dollar showed no weakness, especially last week, and was even able to move much higher. This trend could continue in the coming weeks.

A look at the USDCAD currency pair now shows a clear downtrend. Any setback towards the resistance zone near the 1.3600 mark could offer fresh selling oportunities. In this case, new short positions might be taken. The decision will be made on Wednesday 04 September at 15:45 CET.

– US ADP Employment Change – ADP data from the US this week is expected to be slightly stronger than last month. Sentiment towards the US Dollar has been negative in recent weeks, so positive impulses could move the Greenback back into positive territory.

The weekly chart of the EURUSD currency pair indicates that the market appears to be moving downwards again at the important resistance level of 1.1200. This movement could continue in the coming trading days. This movement could continue in the coming trading days. Better-than-expected data in particular could underpin this trend and the Dollar could rise. However, should the market break through the important resistance, new potential towards the 1.1400 – 1.1500 zone could emerge. The figure will be released on Thursday the 5th of September at 14:15 CET.

– CA- Labor market data – on Friday, the labor market data from Canada will also fall on this month’s NFP report. With 6.5%, the data is expected to be slightly worse than last month. However, if there is an improvement this month as well, this figure could also strengthen the Loonie further.

A look at the EURCAD shows that the EUR is also currently in defeat. The break of the zone at 1.4980 could now unleash further downside potential. The data will be published on Friday 06 September at 14:30 CET.

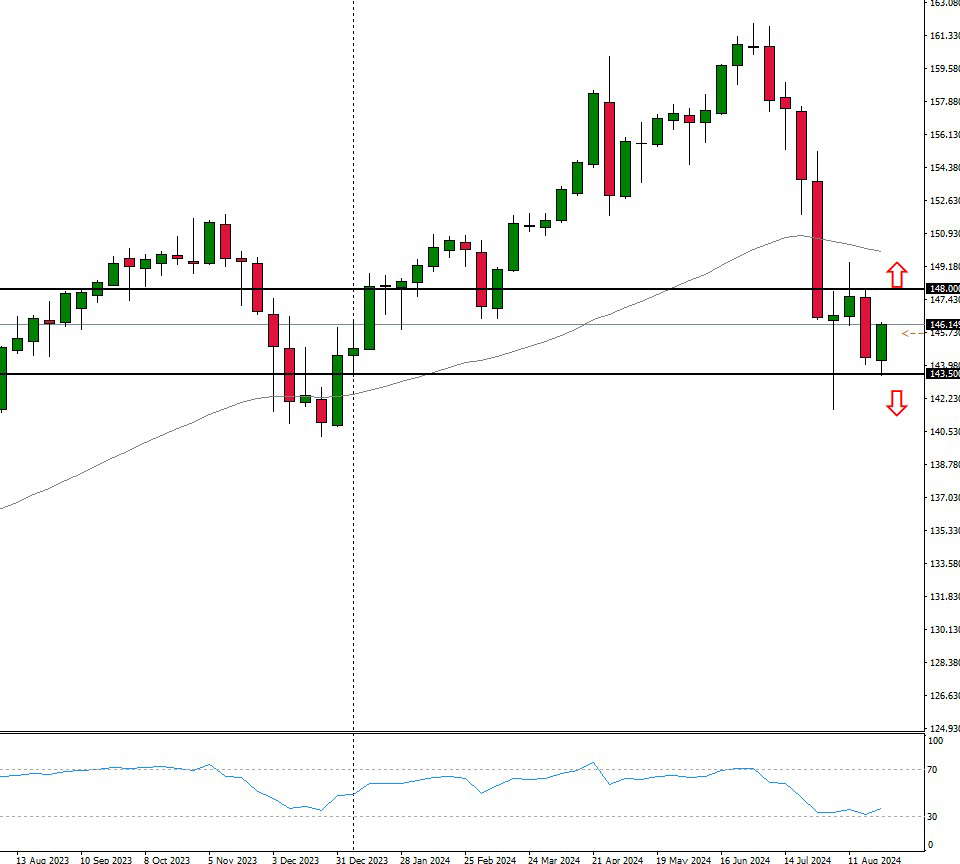

– US (Nonfarm Payrolls) labor market report – The NFP report will show how the US economy is faring.

This week we want to take a look at the USDJPY. According to the weekly chart, there could be potential in both directions. If the current support zone holds, the Dollar could break out of the correction. On the other hand, there could also be further strength in the JPY, which could push the currency pair lower again. The figure will be released on Friday 06 September at 14:30 CET.