Weekly Outlook | Dollar weak, equities in high demand

Important events this week:

Important data is due this week. As the focus is shifting away from inflation data, especially in the US, economic data could provide further insight into the markets. In this case, a look at the minutes of the US Federal Reserve’s meeting may provide further information. At the end of the week, the annual symposium in the US at Jackson Hole will take place. Central bankers and economists from all over the world will meet there to discuss the global economy and a possible direction for interest rate

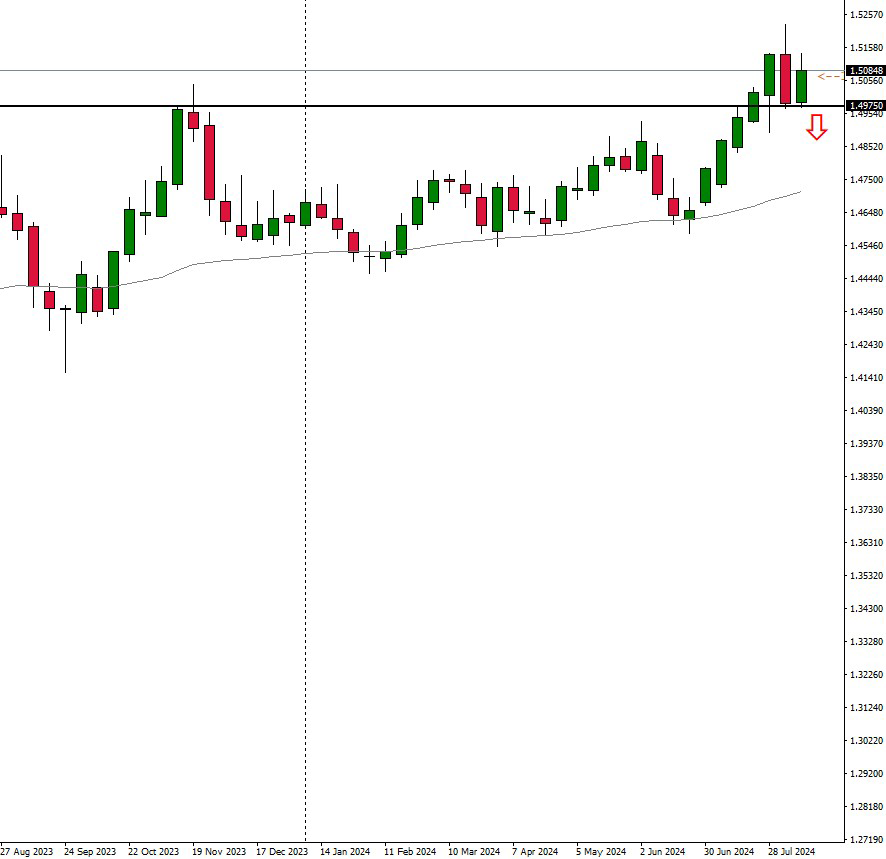

CA – Consumer Price Index – Consumer prices in Canada are expected to fall further. Average consumer prices could head from 2.6% to 2.5%. Weak data could increase pressure on the Canadian Dollar. However, the “Loonie” was slightly stronger against most other currencies last week. In the past, the CAD has been dependent on movements in the oil market, although this is hardly noticeable at the moment.

Against the USD, the Canadian could remain positive and build on its strength. Any retracement to higher levels could be utilized for new sell- entries. The EURCAD is also showing a positive trend in favor of the Canadian Dollar.

The weekly chart shows that resistance could offer further pressure on the market. If last week’s low is broken, downside potential could quickly materialize. An entry point could be found at 1.4975, just below the psychological 1.5000 level. The data will be published on Tuesday, 20 August at 14:30 CET.

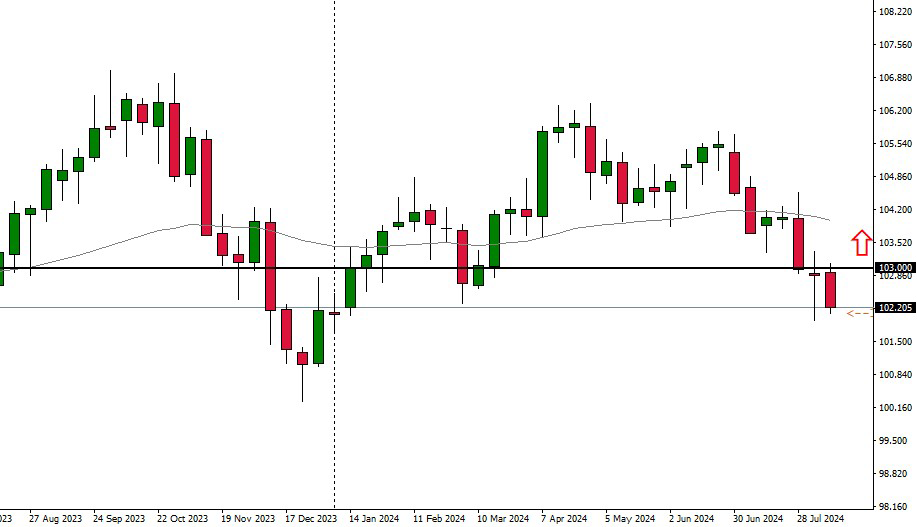

FOMC Meeting Minutes – The meeting minutes will provide further insight into the latest Fed meeting. Only few new insights are expected as the bank will continue to rely on new data. Overall, it should be noted that past meetings have been characterized by unclear statements from Chairman Jerome Powell. If new information does emerge, this might strengthen the Dollar again.

The weekly chart of the Dollar index continues to look weak. The Greenback is currently under pressure against most currencies. The prospect of an interest rate cut could reinforce this trend. Only a break of the 103.00 area could add further potential for the Dollar. The data will be published on Wednesday, 21 August at 20:00 CET.

Jackson Hole Symposium – this week the annual Jackson Hole Symposium is scheduled for the weekend. One of the important topics is likely to be the transition phase of the global economy from the inflationary scenario to a focus at economic data. With consumer prices continuing to fall and labor market data showing a negative impact, this is likely to prompt central banks to cut interest rates again in order to further stimulate the economy. Strong movements in financial markets may not be expected, but background information on the current situation could cause momentum.