When everyone is rushing to invest in the same stock, should you follow suit?

If your answer is yes, you could have herd mentality.

Herd mentality is the tendency for individuals to follow the actions and behaviours of a larger group.

Not only is understanding herd behaviour in financial markets crucial for preventing costly mistakes, identifying when herd mentality is driving market movements can also help investors avoid falling into speculative bubbles and making decisions based on fear or greed, rather than proper analysis.

In this article, we will explore the concept of herd mentality in trading, examine its impact on market movements and individual trading decisions, and provide strategies to help you avoid falling victim to this common psychological trap.

What is Herd Mentality?

Herd mentality refers to a psychological phenomenon where individuals adopt the beliefs, behaviours, or attitudes of the majority within a group. This behaviour is often driven by the fear of missing out (FOMO) and the assumption that if everyone else is doing something, it must be the right thing to do.

In the context of trading, this can lead to buying or selling assets simply because others are doing so, without conducting thorough analysis.

Some factors contributing to herd mentality include insights from well-known analysts, incomplete information, buzz on social media, and market momentum.

Historical Examples of Herd Mentality in Financial Markets

Here are some examples of significant financial bubbles that have occurred in the past:

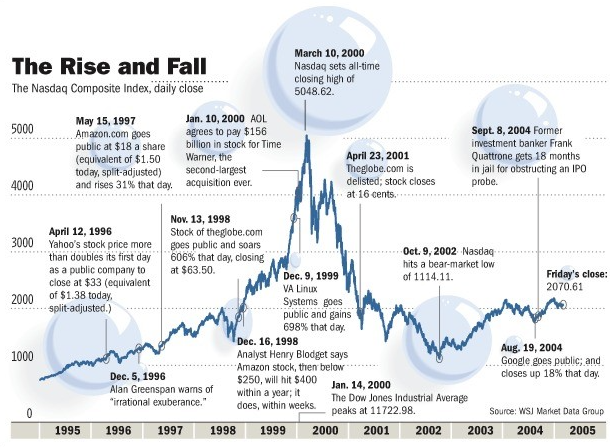

The Dot-Com Bubble (1995-2000) [1]

The dot-com bubble was a period of intense stock market excitement driven by investments in internet companies. Tech stocks surged, and the Nasdaq Composite Index grew five-fold as investors believed that any internet-related business would succeed, leading to severely inflated valuations.

As the bubble grew, many internet startups received large investments despite having weak business models or clear paths to profitability. The market was flooded with companies that had high price-to-earnings ratios and little actual revenue or assets.

In early 2000, the market sentiment shifted as investors realised that these valuations were unsustainable. Confidence dropped, causing the Nasdaq to crash and wiping out many dot-com companies which went bankrupt, leading to substantial financial losses for investors and a significant shakeup in the technology sector.

The Housing Market Crash (2007-2008) [2]

The housing market crash was triggered by speculative behaviour. Many investors bought real estate, believing prices would keep rising indefinitely. This belief was fuelled by aggressive lending practices, including subprime mortgages, which allowed borrowers with poor credit histories to obtain home loans with little scrutiny.

As demand soared, housing prices surged, creating a bubble.

When the bubble burst, prices fell sharply, leading to widespread foreclosures. This wave of defaults caused a severe liquidity crisis for financial institutions heavily invested in mortgage-backed securities.

This period saw home values increasing rapidly, with some areas experiencing price gains of 10% or more annually. Lenders also engaged in risky practices, such as offering adjustable-rate mortgages with low initial payments that would later reset to much higher rates, further inflating the bubble.

When the bubble burst in 2007, housing prices began to fall sharply.

This decline triggered a wave of foreclosures as homeowners, unable to meet their mortgage payments, defaulted on their loans. The surge in defaults led to a severe liquidity crisis among financial institutions that had heavily invested in mortgage-backed securities—financial products composed of bundled home loans. As these securities lost value, banks faced massive losses, which in turn led to tighter credit conditions and further economic turmoil.

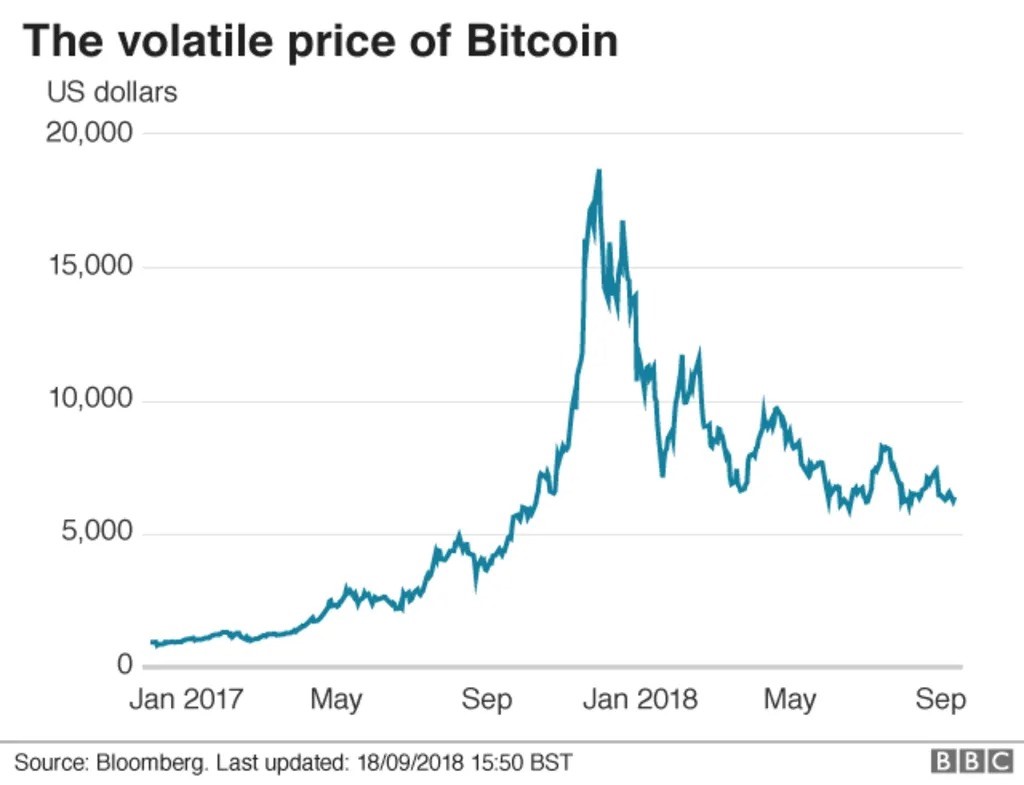

Bitcoin Mania (2017) [3]

In 2017, Bitcoin saw a dramatic price increase driven by herd behaviour and the fear of missing out (FOMO) on the cryptocurrency boom. The cryptocurrency’s value skyrocketed from under $1,000 at the beginning of the year to nearly $20,000 by December, drawing widespread attention and investment. As Bitcoin’s value surged, more investors jumped in, eager to profit from its rapid rise.

This rush was marked by a lack of understanding of Bitcoin’s technology and market fundamentals, with investors primarily focused on the soaring price and potential quick gains.

However, the bubble proved unsustainable.

In early 2018, Bitcoin’s price began to fall sharply, dropping to around $6,000 by February and continuing to decline throughout the year. This collapse resulted in significant financial losses for many investors who had bought in at the peak.

Impact of Herd Mentality on Market Movements [4][5]

Here are some ways herd mentality can affect market movements:

1. Forms stock market bubbles

These bubbles occur when asset prices rise exponentially over a period, far exceeding their intrinsic value. Eventually, these inflated prices reach a breaking point and fall rapidly, causing the bubble to “pop” and leading to substantial losses for investors.

2. Creates echo chambers

Investors selectively expose themselves to information that confirms their existing beliefs. This selective exposure can be particularly pronounced among professional investors who trade based on strong convictions. In these echo chambers, investors may see predominantly bullish messages and fewer bearish ones, reinforcing their biases and making them more susceptible to herd behaviour.

3. Drives market volatility

Herd mentality causes large groups of investors to make collective, emotionally-charged decisions rather than independent, rational ones. This behaviour leads to exaggerated price swings, as investors buy or sell in large numbers based on trends or news.

4. Creates feedback loops

This in turn creates feedback loops where rising prices attract more buyers and falling prices trigger more selling, amplifying market movements and driving prices away from their true values.

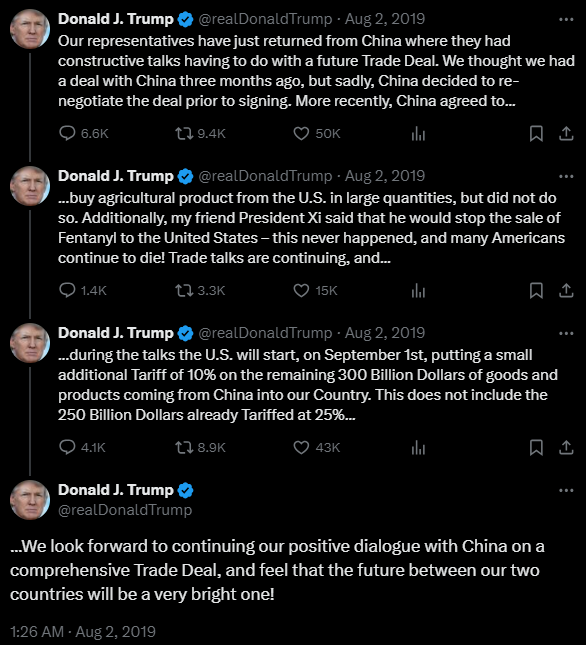

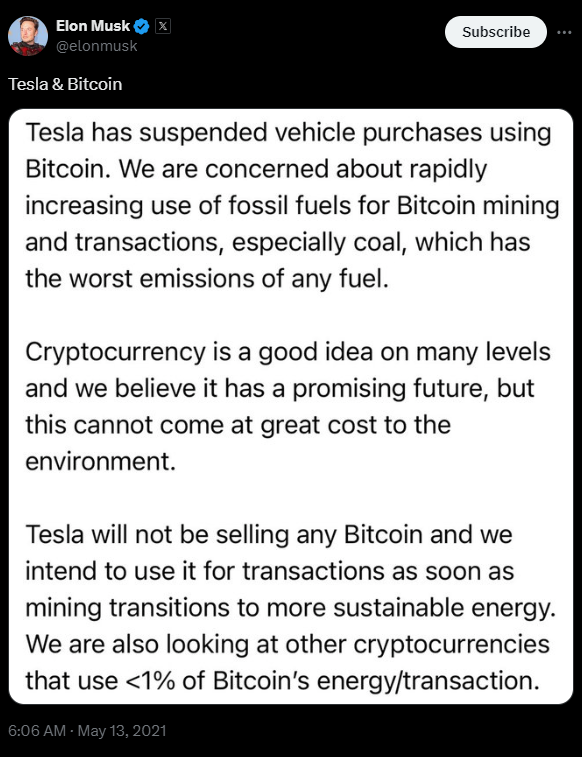

The media and social networks play a key role in amplifying herd behaviour. Sensational news, viral social media posts, and influential opinions can trigger immediate, widespread reactions from investors. Just think about the posts on X made by Elon Musk, or Donald Trump and how they can easily influence the markets.

In August 2019, the Dow Jones Industrial Average fell by 280.85 points, a drop of over 1%, while the S&P 500 decreased by 0.9% to 2,953.56, and the Nasdaq Composite declined by 0.8% to 8,111.12. This market downturn occurred following a tweet from then-President Donald Trump announcing the imposition of an additional 10% tariff on Chinese goods starting in early September.

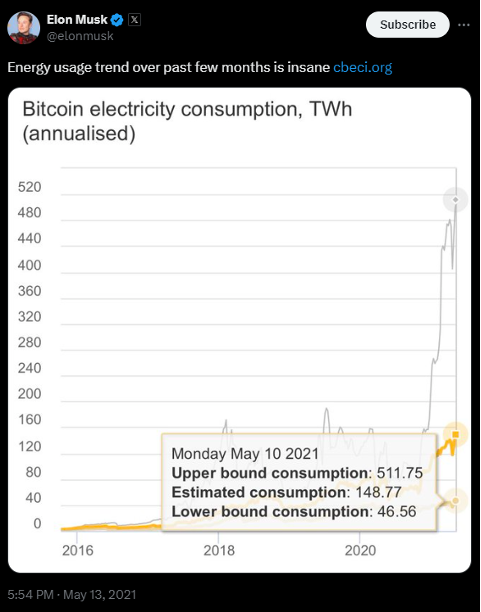

In May 2021, Elon Musk announced via Twitter that Tesla would no longer accept Bitcoin as payment, citing the “insane” energy usage trend in recent months. Following Musk’s remarks, Bitcoin plummeted by 17% to its lowest point since March 2021. Other cryptocurrencies, including Ether, also declined before partially recovering. Tesla’s shares closed 3.08% lower, reaching their lowest level since March 2021.

This rapid spread of information often leads to irrational price swings and increased market instability.

The media’s influence can create hype around specific stocks or sectors, leading to buying frenzies or panic selling.

One of the most notable recent examples is the GameStop Short Squeeze. The GameStop stock price skyrocketed when a group of retail investors on the Reddit forum r/WallStreetBets began purchasing shares in large quantities. Media coverage fuelled the excitement, drawing in more investors and causing a buying frenzy. As a result, the stock price surged from approximately $20 to nearly $500 within a few weeks [6].

In the digital age, the swift dissemination of information magnifies herd behaviour, as investors react quickly without thorough analysis, further contributing to market volatility.

You can read more about news trading here.

Impact of Herd Mentality on Individual Trading Decisions

As mentioned at the beginning, investors often experience a sense of FOMO when they see other investors trading the same assets. This compels them to follow the crowd in hopes of not missing potential gains.

Here are some negative impacts of herd mentality on individual trading decisions:

1. Could harm individual portfolios

Those who follow the crowd may end up buying overvalued assets or selling when there is panic in the markets, resulting in significant losses. Poor timing of trades and missed investment opportunities can erode portfolio value and hinder long-term financial goals.

2. Makes traders more dependent on prevailing market narratives

This dependence on market noise can lead to ill-informed decisions, as traders might act on rumours or hype rather than sound financial principles. As a result, the trading strategies become reactive instead of proactive, increasing the likelihood of making impulsive and detrimental decisions.

3. Creates a false sense of security among traders

When everyone is making similar moves, it may appear that the collective action is safe and rational. However, this can be misleading, as market conditions can change rapidly, and what seems like a prudent decision today may turn out to be a costly mistake tomorrow. This false security often prevents traders from critically evaluating their positions and making necessary adjustments.

Learn how to manage these emotions in our guide on FUD.

Strategies to Avoid Falling into the Herd Behaviour Trap

Herd behaviour can lead to costly mistakes, as investors often make decisions based on emotions rather than rational analysis. To potentially safeguard your investments and to potentially achieve long-term success, it’s crucial to adopt strategies that help you stay disciplined, informed, and objective. Here are some effective methods to avoid falling into the herd behaviour trap.

1. Conduct Independent Research and Analysis

It is important to conduct research and analysis on your own. Evaluate the fundamental and technical aspects of investments using indicators instead of relying on popular opinions or market hype. By basing decisions on solid research, traders can identify genuine opportunities and avoid exaggerated valuations.

Here are some articles to help you get started:

The Basics of Technical Analysis in a Nutshell

The Basics of Fundamental Analysis for Forex Market

Fibonacci Retracement Guide: How to Use It

Trend Analysis Complete Guide: How to Use It

2. Develop a Disciplined Trading Strategy

Set clear investment goals, establish entry and exit criteria, and adhere to these rules consistently. This structured approach helps maintain focus on long-term objectives rather than bring swayed by short-term market movements influenced by herd mentality.

3. Manage Emotions and Cognitive Biases

It is important for all traders to remain calm during sudden market movements. This can be achieved by using techniques such as mindfulness and stress management, which are crucial aspects of trading psychology. Being aware of biases like the bandwagon effect and confirmation bias can also allow traders to recognise irrational influences. Consider keeping a trading journal and setting predetermined rules to help maintain objectivity.

4. Diversify Your Portfolio and Manage Risk

Diversification and risk management are vital to countering herd behaviour. Spread investments across different assets, sectors, and regions to reduce the impact of any single market movement. Employ risk management techniques such as setting stop-loss orders and regularly reviewing the portfolio to potentially protect against significant losses and ensure stability.

By incorporating these strategies, investors can better navigate the market with confidence and resilience, potentially minimising the negative impacts of herd behaviour.

Conclusion

Herd mentality in financial markets can lead to significant risks and financial losses. Understanding this psychological phenomenon is crucial for investors to make informed, rational decisions. By recognising the impact of herd behaviour, traders can avoid the pitfalls of following the crowd and instead focus on disciplined strategies, independent research, and effective risk management. Implementing these strategies potentially helps safeguard individual portfolios and supports long-term financial goals, enabling investors to navigate the market with confidence and resilience.

At Vantage Markets, we provide the tools, resources, and support you need to navigate the market confidently and independently. Open a live account with Vantage today to leverage our comprehensive platform and stay ahead of market trends with a strategic, disciplined approach.

References:

- “Dot-com Bubble Explained | Story of 1995-2000 Stock Market – Finbold”. https://finbold.com/guide/dot-com-bubble/. Accessed 19 July 2024.

- “The Fall of the Market in the Fall of 2008 – Investopedia”. https://www.investopedia.com/articles/economics/09/subprime-market-2008.asp. Accessed 19 July 2024.

- “What’s Behind Bitcoin Mania? – Jacobin”. https://jacobin.com/2017/12/bitcoin-price-crypto-currency-explainer/. Accessed 19 July 2024.

- “The Dow Tumbled Because Trump Restarted the Trade War – Barrons’”. https://www.barrons.com/amp/articles/president-donald-trump-tweets-new-tariffs-on-china-and-sinks-the-dow-jones-industrial-average-51564683101. Accessed 7 August 2024.

- “Musk decries bitcoin’s ‘insane’ energy use after Tesla payment U-turn – Reuters”. https://www.reuters.com/technology/musk-decries-bitcoins-insane-energy-use-after-tesla-payment-u-turn-2021-05-13/. Accessed 7 August 2024.

- “GameStop Stock Short Squeeze — What Happened in 2021 – Market Realist”. https://marketrealist.com/p/gamestop-stock-explained/. Accessed 7 August 2024.