Weekly outlook | week with important data ahead

Important events this week:

There was little news last week, offering on limited volatility for the FX market. The Dollar moved sideways, with equities initially showing downward pressure. However, fresh buying took place at the end of the week, which could now lead to further upward potential. This week, a series of important data might cause volatility, as upcoming key interest rate decisions in particular are likely to cause momentum.

– US ADP employment change – The employment change serves as a preview of the NFP data on Friday. In general, a possible divergence in the result is causing increased volatility, with this month’s data predicted to be rather low at 175,000 new jobs. A better-than-expected figure could therefore cause the greenback to strengthen. The GBPUSD currency pair might offer potential downside momentum.

According to the daily chart, a break of the support at 1.2690 might ignite further downside potential based on the long-term trend. The figure will be released on June 5 at 14:15CET.

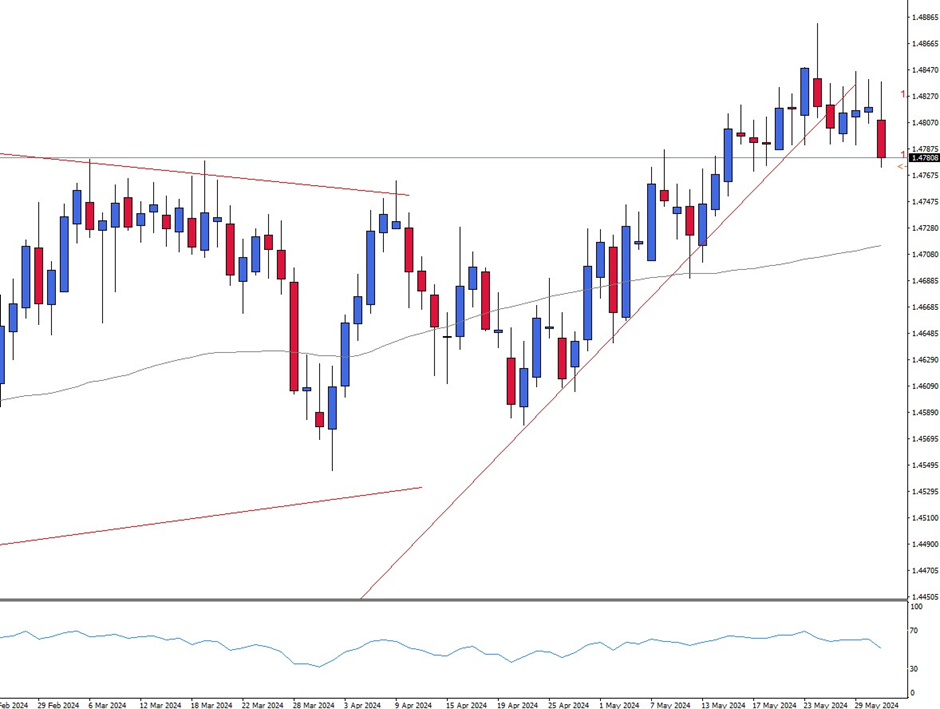

– CA- Interest Rate Decision- As inflation data has cooled in recent months, there could now be a cut in Canada’s key interest rate. However, the news is generally anticipated and hence considered to be “priced in” accordingly as per the expectation.

The EURCAD pair might offer exciting opportunities. The market currently trades at a resistance area and could now show new downside potential unless the 1.4800 zone is broken to the upside. Important news could follow during the press conference thereafter. A hint of possible further interest rate moves could then move the CAD. The interest rate decision will take place on June 5 at 15:45CET.

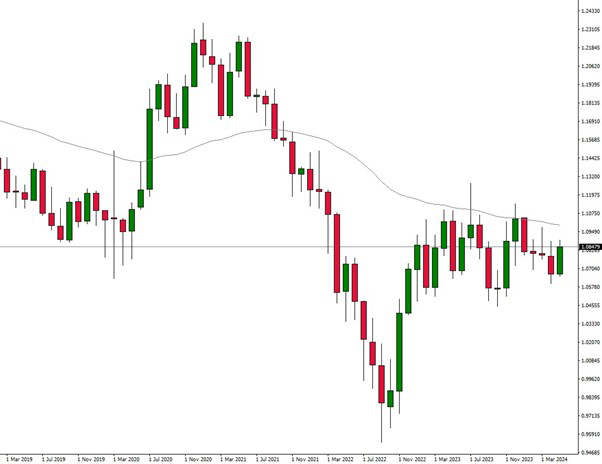

– EU key interest rate decision – an important interest rate decision will also follow by the ECB this week. The central bank is also expected to reduce rates down from 4.5% to 4.25%.

However, it is doubtful whether the Euro will weaken as a result, as the price had moved up again in May and could spark further potential towards the 50-moving average. The focus should therefore be on Christine Lagarde’s wording during the press conference, which could then cause fresh volatility. The interest rate decision will take place on June 6 at 14:15CET.

– US Nonfarm Payrolls – The trading week will be rounded off with the Nonfarm Payrolls report, which is expected to come in at 185,000 newly created jobs. A better figure should therefore strengthen the Dollar again.

The USDCAD currency pair might offer potential volatility on this event, as further downward pressure could follow. In particular, better than expected unemployment figures, which come out at the same time from Canada could give the Loonie an advantage. The figure will be published on June 7 at 14:30CET.